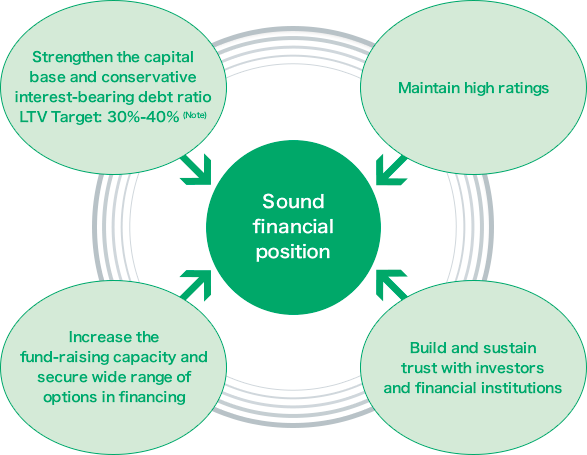

Financial Policy

JRE aims at stable asset management on a medium-to long term basis by maintaining sound financial position.

Secure sound financial position

| (Note) | Interest-bearing debt ratio (LTV) (%) = Interest bearing debts/ Total assets ×100 |

|---|

Financing

■ Issuance of investment units

JRE procures funds by issuance of investment units to allocate funds for repaymaent of loans and acquisition of assets, etc.

■ Interest-bearing debt

JRE mainly obtains loans from financial institutions for property acquisition and also issue investment corporation bonds for the same purpose.

| Loans | Investment Corporation Bonds | |

|---|---|---|

| Purpose | Funds for acquisition of assets, repairing cost and operation fee for properties in its possesions | |

| Limit | Up to JPY one trillion | |

| Lenders | Qualified institutional investors | − |

| Collateral | Invested assets may be provided as collateral in some cases. | |

Financing policy

■ Secure capability of financing

JRE secures the capability of fund raising with long-term and large amount at low interest rate for stable management.

■ Long-term and fixed interest-bearing debt

JRE maintains high ratio of long-term and fixed interest-bearing debt in case of risks causing from higher interst rate.

■ LTV

JRE adopts LTV target level in the range of 30% for the conservative financing.