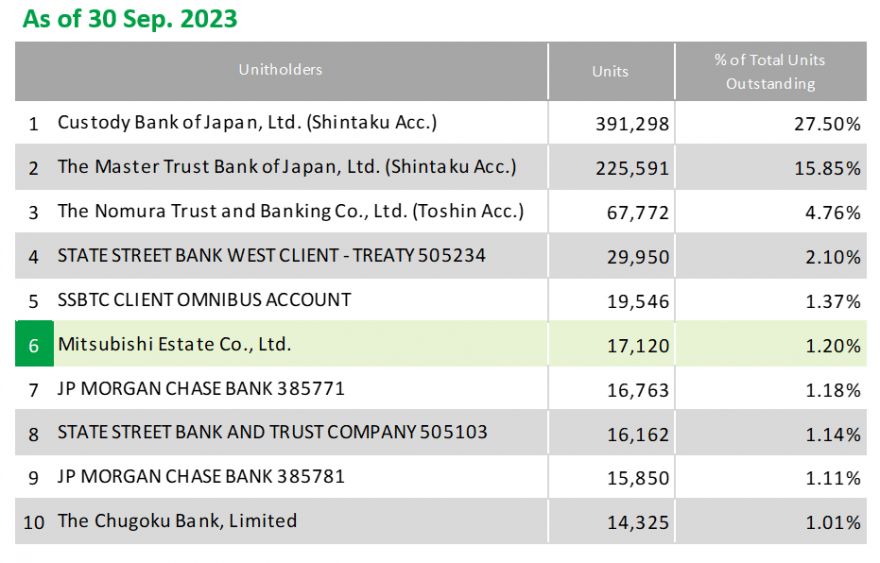

Unitholders' Equity / Principal Unitholders

Unitholder Composition

(As of September 30, 2023)

| Number of Units | Total 1,422,864 units |

|---|

- ■Individuals69,558 units(4.9%)

- ■Financial Institutions907,073 units(63.8%)

- ■Other Corporations61,499 units(4.3%)

- ■Foreign Corporations and Individuals384,734 units(27.0%)

| Number of Unitholders | Total 16,637 |

|---|

- ■Individuals15,311(92.03%)

- ■Financial Institutions250(1.50%)

- ■Other Corporations466(2.80%)

- ■Foreign Corporations and Individuals610(3.67%)

Trend of Unitholders' Equity

(As of May 1, 2023)

| Date | Remarks | Investment Units Issued and Outstanding (units) |

Total Unitholders' Equity (JPY million) |

||

|---|---|---|---|---|---|

| Changes | Balance | Changes | Balance | ||

| 05/11/2001 | Private Placement | 400 | 400 | 200 | 200 |

| 09/08/2001 | Public Offering | 160,000 | 160,400 | 81,060 | 81,260 |

| 05/08/2002 | Public Offering | 65,000 | 225,400 | 30,892 | 112,152 |

| 10/25/2003 | Public Offering | 35,000 | 260,400 | 21,295 | 133,448 |

| 04/26/2005 | Public Offering | 85,000 | 345,400 | 68,024 | 201,472 |

| 10/24/2006 | Public Offering | 64,600 | 410,000 | 63,211 | 264,683 |

| 03/12/2008 | Public Offering | 33,000 | 443,000 | 32,917 | 297,601 |

| 12/08/2009 | Public Offering | 42,000 | 485,000 | 24,319 | 321,921 |

| 12/22/2009 | Third-party Allocation | 4,200 | 489,200 | 2,431 | 324,353 |

| 02/28/2012 | Public Offering | 54,400 | 543,600 | 35,471 | 359,824 |

| 03/27/2012 | Third-party Allocation | 5,440 | 549,040 | 3,547 | 363,371 |

| 10/29/2012 | Public Offering | 41,000 | 590,040 | 29,678 | 393,050 |

| 11/28/2012 | Third-party Allocation | 4,100 | 594,140 | 2,967 | 396,018 |

| 01/01/2014 | Split | 594,140 | 1,188,280 | 0 | 396,018 |

| 04/15/2014 | Public Offering | 57,500 | 1,245,780 | 27,968 | 423,986 |

| 05/14/2014 | Third-party Allocation | 5,750 | 1,251,530 | 2,796 | 426,783 |

| 04/06/2015 | Public Offering | 54,000 | 1,305,530 | 29,189 | 455,972 |

| 05/11/2015 | Third-party Allocation | 3,780 | 1,309,310 | 2,043 | 458,016 |

| 04/16/2018 | Public Offering | 69,000 | 1,378,310 | 35,659 | 493,675 |

| 05/09/2018 | Third-party Allocation | 6,900 | 1,385,210 | 3,565 | 497,241 |

| 04/07/2023 | Public Offering | 35,200 | 1,420,410 | 18,224 | 515,466 |

| 05/01/2023 | Third-party Allocation | 2,454 | 1,422,864 | 1,270 | 516,736 |